How Bitcoins and other Cryptocurrencies are Taxed in UK

What is Bitcoins and Cryptocurrencies

- What is Bitcoins and Cryptocurrencies

- Legality of Cryptocurrencies.

- What is HMRC view on Cryptocurrencies

- How Bitcoins and other Cryptocurrencies are Taxed in UK

- Tax implication for a Hobby and Speculative Trade

Key Points

- Cryptocurrency is a decentralized digital currency

- Operates via a peer to peer network, independent of any central authority or bank

- All transactions are recorded in a shared public database called a ‘block-chain’

- Held as an investment or used to pay for goods or services at merchants where it is accepted

The advent of cryptocurrencies such as Bitcoin is a new and evolving area it is important to understand the definitions of some of the key terms used in this subject.

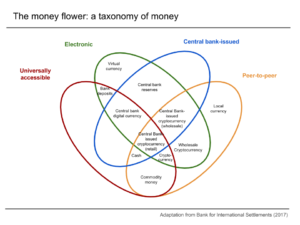

Digital (electronic) currencies: any money that is not held physically (such as Notes or Coin), and stored and transferred electronically. Digital currencies have been around for some time and in the increasingly cashless society currencies are becoming digital.

Virtual Currency: The European Central Bank (ECB) defines a virtual currency as ‘a digital representation of value, not issued by a central bank, credit institution or e-money institution, which in some circumstances can be used as an alternative to money’. Mostly virtual currencies are digital currency.

Cryptocurrency: A cryptocurrency is a digital virtual currency that uses encryption technology (or cryptography) and record it transaction in a public distributed ledger called a blockchain.

Bitcoin: is the world first and the most popular cryptocurrency. Currently there are over 1000 other cryptocurrencies in use, Ethereum, Litecoin, Ripple, Bitcoin Cash are some of the populate cryptocurrencies.

Blockchain/Distributed ledger technology is an exciting innovative technology that is redefining how we store, update, and move data. Blockchain uses decentralized, encrypted data storage. Most popular use of the technology is in cryptocurrency however the technology is currently being development in several different industries, including energy, travel, logistics and security.

Legality of Cryptocurrencies.

As with all new technology – it takes time for regulators to catch up. Cryptocurrencies are not yet being fully implemented into the legal framework of many countries across the globe. Most cryptocurrencies use around the world is legal and unregulated at present including US and UK. Some countries have incorporated it into their financial system, but very few have outright banned it.

Cryptocurrency has various legal aspects to consider depending on the country. Some countries class Bitcoin and other virtual currency as money and legal, some class it as an asset and legal, some class it as neither illegal nor legal, with no legal frameworks in place.

Other Legal Issues/challenges

Other key legal issues of recent times include the following:

- Large thefts, ransom and kidnapping.

- Banning of Bitcoin in certain countries.

- Loss of Bitcoin private keys hard to prove.

- Online drugs marketplaces.

- Chargeback ability and scams.

- Hiding assets.

- Lack of legal protections.

Cryptocurrency transactions

Buy, Sell and Donate

You can buy Cryptocurrency using conventional currency and either held as an investment, use it to pay for goods and services or donate as Gift to another person. Disposing” of Bitcoin (swapping it for fiat or any other asset, including other cryptos) triggers a taxable event.

Receive and Pay

Merchant where cryptocurrency is accepted you can receive cryptocurrency for good and service provided. There are growing number of outlets in UK already accepts cryptocurrency payment. Also, you can earn cryptocurrency when you provide a service such as mining service or exchange service.

What is HMRC view on Bitcoin and Cryptocurrencies

Key Pinots

- It is Legal in UK

- Currently no new regulations specific to Cryptocurrencies

- AML and Counter terrorism laws are currently being reviewing to extend to include (Cryptocurrencies) service providers .

- HMRC treat bitcoins (Cryptocurrencies) like a foreign currency for corporation and income tax

HMRC has not introduced any new legislation that relates specifically to cryptocurrencies as it believes that the existing legislation is sufficient to impose any necessary tax. HMRC view on this topic has been published in the Revenue and Custom Brief 9 (2014) Bitcoin and other cryptocurrencies.

Regulators and Government agencies around the world are increasingly worried about the implications of Cryptocurrency as a potential instrument for money laundering. The anonymity and instant transfer of fund globally, making it attractive to criminals and tax avoiders.

The UK Treasury has announced recently that it intends to bring the bitcoins (Cryptocurrencies) in line with AML rules and counter-terrorism financial legislation. This will force traders to disclose their identities and report suspicious activity. The new rules, which will be applied across the European Union, are expected to come into force in early in 2018. This could pave the way toward a new regulatory framework for cryptocurrencies in UK.

How Bitcoins and other Cryptocurrencies are Taxed in UK

Tax treatment of any transaction involving the use of cryptocurrencies needs to be looked at on a case-by-case basis considering the specific facts, each case being considered based on its own individual facts and circumstances. Transactions that are subject to (direct) tax (such as a sale or disposal made for Bitcoins) need to be analysed in the same way as any other transaction—broadly, by reference to the nature of the activities (to determine whether the receipt or expenditure is income or capital) and the status of the parties (to determine whether income tax, CGT or corporation tax is relevant).

As per HMRC the tax treatment of Bitcoin and Cryptocurrencies, the general rules on foreign exchange and loan relationships apply’ and that they have not at this stage identified any need to consider bespoke rules’. However due to the “evolving” nature of the cryptocurrency market means it is likely that further guidance is likely to be produced in future.

VAT – Bitcoin (Cryptocurrencies)

As per the HMRC Brief 9 2014 following rules application for VAT treatment of the transactions. HMRC also further states that any future changes to the VAT rules will not be applied retrospectively.

- income received from Bitcoin mining activities will generally be outside the scope of VAT on the basis that the activity does not constitute an economic activity for VAT purposes.

- income received by miners for other activities, such as for the provision of services in connection with the verification of specific transactions for which specific charges are made, will be exempt from VAT under Article 135(1)(d) of the EU VAT Directive

- when Bitcoin is exchanged for Sterling or for foreign currencies, such as Euros or Dollars, no VAT will be due on the value of the Bitcoins themselves

- charges (in whatever form) made over and above the value of the Bitcoin for arranging or carrying out any transactions in Bitcoin will be exempt from VAT under Article 135(1)(d) as outlined at 2 above

- However, in all instances, VAT will be due in the normal way from suppliers of any goods or services sold in exchange for Bitcoin or other similar cryptocurrency. The value of the supply of goods or services on which VAT is due will be the sterling value of the cryptocurrency at the point the transaction takes place

Income Tax – Bitcoin (Cryptocurrencies)

An Individual or un-incorporated business make a sale in the course of a trade, which is subject to income tax and thus required to compute the profits of its trade in accordance with generally accepted accounting practice (GAAP), also would be required to record the sales using an accounting standard applicable to the reporting of foreign exchange transactions. FRS 102, for example, would require the business first to translate the foreign currency transactions (ie the sales) into (say) sterling using the spot exchange rate (or an average rate for a week or month, if the exchange rate does not fluctuate significantly), and then, at the end of the reporting period, to translate foreign currency monetary items at the exchange rate applicable at that time.

Corporation Tax- Bitcoin (Cryptocurrencies)

If, instead of being unincorporated, the business were a company and subject to corporation tax, HMRC offers the following brief guidance: ‘For companies, exchange movements are determined between the company’s functional currency (usually the currency in which the accounts are prepared) and the other currency in question. If there is an exchange rate between Bitcoin and the functional currency then this analysis applies. Therefore, no special tax rules for Bitcoin transactions are required. The profits and losses of a company entering into transactions involving Bitcoin would be reflected in accounts and taxable under normal CT rules’.

Capital Gain Tax Bitcoin (Cryptocurrencies)

If, instead of making sales for Bitcoins in the course of a trade, the individual or business disposed of

an investment asset, and the transaction were subject to CGT rather than income tax, it would be carrying out a barter transaction, and the consideration for CGT purposes would be the sterling equivalent of the Bitcoins at the date of the disposal.

Inheritance Tax -Bitcoin (Cryptocurrencies)

If you donate a Cryptocurrency you need to consider the IHT implications. You could utilize certain tax planning measures to minimize the taxes. There is a £325,000 nil rate band. if you make a gift to someone and survive 7 years you (potentially except transfer) are unlikely to have to pay any further tax on it. Also, there is a £3,000 annual allowance on gifts that can be used. This is a yearly limit and you can bring forward 1 years’ worth of unused allowance as well. So potentially £6,000 of gifts can be made in a tax year without any tax. Also, assets transferred between spouses occur at no gain no loss, so this can be used to shift the income partner who is on a basic tax band and to make use of the their income tax and capital gain allowances during a tax year.

Stamp Duty Tax Bitcoin (Cryptocurrencies)

HMRC has not issued any guidance on how Bitcoin should be treated for SDRT or SDLT purposes.

Tax Summary

| Non-incorporated Business (Individuals and partnerships) | Incorporated Business (Limited Company) | |

| Income from non-trading activities such as a Hobby or speculative activities (Gambling)

| Non-Taxable (Subject to acceptance by HMRC) | Non-Taxable (Subject to acceptance by HMRC) Highly unlikely us most companies article of association to restrict these kind of activities. |

| Income during the course of trade | Chargeable for Income Tax based on Profit and Loss Account under UK GAAP | Chargeable for Corporation Tax based on Profit and Loss Account under UK GAAP. |

| Gain from dispose of Investment Assets | Chargeable for Capital Gain Tax for the gain at the date of Disposal. | Chargeable for Corporation Tax for the gain at the date of Disposal. |

Tax implication for Hobby/Speculative/Trade activities

Activities which generate speculative gain are not taxable in UK e,g gambling or betting wins (which are not taxable) and gambling losses (which are not available for offset against other taxable profits). Therefore, one can argue that cryptocurrency transactions are speculative and like gambling and it is not a trade, and therefore not taxable.

Similarly, many people have hobbies that generate money, such as buying and selling items at car boot sales or on eBay. If the activities are considered to be a hobby, then any gain (which are not taxable) and any losses (which are not available for offset against other taxable profits). Therefore, one can argue that cryptocurrency transactions are a hobby and it is not a trade, and therefore not taxable.

An individual may contend that loss-making activities amount to a trade so that relief for trading losses can be offset against the individual’s other income (under ITA 2007, s 64), often referred to as ‘sideways loss relief’). similarly, an individual may contend that profit making activities amount to a non-trade, which are not taxable.

Is there a trade?

Unfortunately, there is very little guidance on the meaning of ‘trade’ in the tax legislation. A trade is simply defined (in ITA 2007, s 989) as including ‘any venture in the nature of trade’. The lack of statutory guidance on the meaning of ‘trade’ has resulted in extensive case law over the years.

The ‘badges of trade’ can sometimes be helpful. These were first established by the Royal Commission for the Taxation of Profits and Income in 1955, using previous case law about what constitutes a trade. Subsequently, in Marson v Morton Ch D 1986, 59 TC 381, a total of nine badges were identified. HMRC guidance (in the Business Income manual at BIM20205) lists the badges as follows:

- profit-seeking motive;

- the number of transactions;

- the nature of the asset;

- existence of similar trading transactions or interests;

- changes to the asset;

- the way the sale was carried out;

- the source of finance;

- interval of time between purchase and sale; and

- method of acquisition.

However, Marson v Morton and other case law (Salt v Chamberlain Ch D 1979, 53 TC 143) indicates that the badges of trade should not be used as a checklist to conclude whether a trade does (or does not) exist. The above HMRC guidance also urges caution about relying too heavily on the badges of trade.

Is it commercial?

Even if it is accepted that there is a trade, HMRC will sometimes argue that the trade is not being undertaken on a commercial basis, and/or with a view to the realisation of profits of the trade. Sideways loss relief is not available in those circumstances (ITA 2007, s 66).

HMRC’s guidance (at BIM20050 and following) includes extensive commentary on the meaning of ‘trade’. HMRC’s view and its general approach in establishing whether or not a trade exists. A detailed business plan may be helpful in establishing that a trade is being carried on commercially, and with a view to making profits. The government announced in Budget 2016 a new allowance of £1,000 for trading (and property) income from April 2017. This will be particularly helpful for those whose trading activities are on the smallest scale.

Practical point and key Challenges

- International matters – If the client trades internationally, things could become complex as there is no consensus as to the treatment of bitcoin in different jurisdictions.

- Exchange rate

- Record Keeping

- Security and safety

- Taxation

My Accountancy Team How Can we help

MAT ‘s tax advisors are able to advise on the tax implications of Bitcoin other cryptocurrencies related transactions, to ensure that all tax compliance reporting requirements are made promptly to HMRC. This will provide peace of mind and the assurance that you are complying fully with the UK law relating to Bitcoin and other cryptocurrencies.

If you have a question or would like to discuss your cryptocurrency related tax matters, please contact My Accountancy Team today to arrange free initial Consultation. Phone 02080905025, Email [email protected]